2022 Renewal of Maryland Sales and Use Tax Exemption Certificates

Guidance to Local BWC Churches (PDF Version)

Maryland Churches received Renewal Notices in the mail in early June to renew their Non-Profit Sales and Use Tax Exemption Certificates. Incorporated churches will register on-line and churches that are not incorporated will need to request a paper application. Please see the details below for each scenario:

Instructions for Incorporated Churches

Applications for renewals are filled out at the following website and they must be submitted by August 1, 2022. Certificate renewals are performed every 5 years in Maryland.

https://interactive.marylandtaxes.com/bServices/EOR/Home.aspx

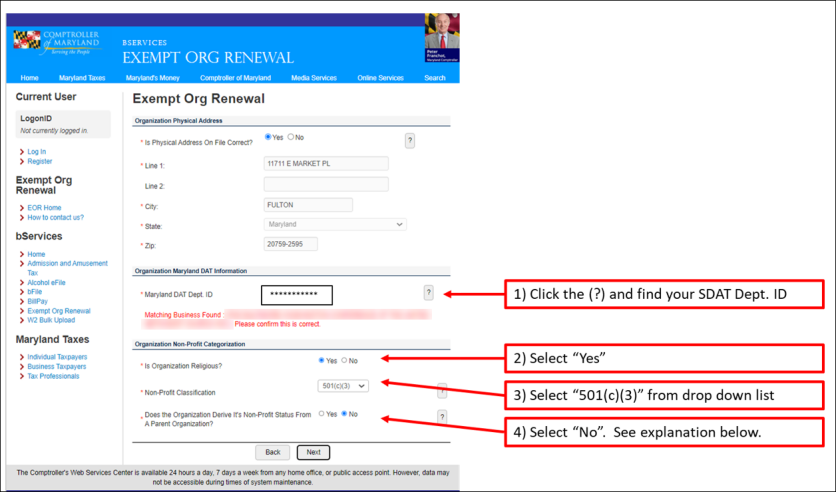

Below are the directions on how churches can complete Page 2 of the online sales tax exemption renewal for Maryland. Please read this carefully to avoid confusion.

Why am I choosing “No” to answer the question, “Does the Organization derive its non-profit status from a parent organization?”

Explanation: According to 26 U.S.C. 508(c)(1)(a), churches do not have to obtain recognition of 501(c)(3) status by applying directly to the IRS. In other words, churches have 501(c)(3) status automatically and so it is accurate to select “No” for the last radio button. Because churches automatically have 501(c)(3) status, they also do not have to apply for inclusion in the group exemption. Often donors and grantors want (1) evidence that an organization claiming to be a church is in fact a church and (2) documentation of tax exempt status for their records. The group ruling provides this verification for donors and grantors, which is why the letter is often helpful despite not being needed to obtain 501(c)(3) status.

Instructions for churches that are NOT incorporated

The 2022 FAQ’s for the Maryland Sales and Use Tax Exemption Certificate Renewal Process instructs churches that are NOT incorporated to submit a paper application and mail it to the Comptroller’s office.

Source: https://marylandtaxes.gov/business/docs/SUTEC-Renewal-FAQs.pdf

Question #8: My organization is not incorporated and is not required to be registered with SDAT. How do I renew my organization’s exemption certificate?

Answer: You must request a paper application (Form 202EC) be mailed to you by contacting the Taxpayer Services Division by email at , or by phone 410-260-7980, or 1-800-MD-TAXES. Once you receive the paper application, you must submit the paper application and a copy of your organization’s organizing documents by mail to:

Comptroller of Maryland

Revenue Administration Division

PO Box 2998 – SUTEC Renewal

Annapolis, MD 21404-2998

Unincorporated UM churches should provide a copy of paragraphs 243-258 from the Book of Discipline to satisfy the requirement to submit organizing documents. Download ¶¶ 243-258.

Similar to the on-line applications, the paper applications must be submitted by August 1, 2022.

Please contact the Conference Finance Office at 410-309-3400 or complete the form below if you have questions.